If you’re running a growing business, you know the feeling — Your operations are scaling, but your finance team is stuck bouncing between QuickBooks, your inventory platform, and a dozen spreadsheets to connect the dots. What starts as a minor inconvenience quickly becomes totally distracting, obscuring the true financial health of your business.

The solution isn’t as simple as upgrading software. It’s about deciding when and how to weave accounting into the core of your operations. Some see this as a binary choice: stick with finance software and patch it into other systems, or endure a massive, high-risk migration to a full ERP.

We see a smarter path forward — one that’s phased, pragmatic, and built around your business needs. Build a solid operational foundation, then integrate financials when the time is right.

Defining Accounting Software vs. ERP / ARP

Standalone accounting software (e.g. QuickBooks , Xero ) is good at what it was designed for: recording financial history and reconciling transactions. It’s a reliable rearview mirror, but it operates in isolation.

As your business grows, you need to see what’s happening now and what’s coming around the bend. You also need to trust that your financial data is accurate and up-to-date, which requires data integrations that actually work and have native access to transactional and inventory data.

Enter ERP: a central database that stores and synchronizes information across your entire business, while automating key operations from procurement to inventory, orders, and finance. ERPs are powerful, but they can also be expensive, slow, and painful to implement.

DOSS removes that burden. With a fully composable data model, our Adaptive Resource Platform (ARP) molds to your exact business processes, schemas, and workflows without the usual friction. Deploy in weeks, change workflows in minutes, and keep your business moving.

Three Benefits of ARP for Accounting

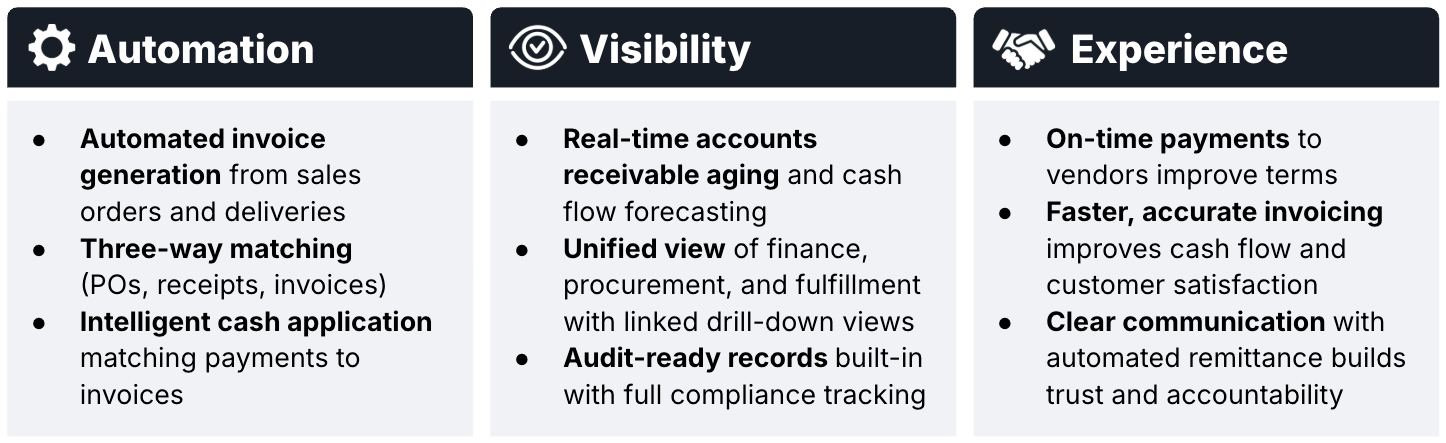

When your accounting functions live inside the same system as your procurement, inventory, and sales with data you can trust, the financial impact of every operational decision becomes instantly visible and reconciliation becomes effortless. The benefits are numerous, but three stand out: automation, visibility, and experience.

1. Automation: Improved Operational Efficiency

Manual data entry isn’t just tedious; it’s a bottleneck that actively slows your growth. With an integrated ARP, processes like three-way matching (comparing purchase orders, goods receipts, and vendor invoices) become automated. Invoices are automatically generated from shipment data, not re-keyed from a separate system. This frees up time for strategic work.

For example, peanut butter brand Spread the Love reduced order processing time by 12x, from 5 hours to 25 minutes per week. DOSS automates the entire wholesale order process from order receipt to 3PL warehouse management to fulfillment and payment. Invoices are generated automatically and sent with integrated payment links for seamless transactions.

“DOSS has really freed us up to do a lot of other higher-value stuff. I used to have to create every invoice in QuickBooks manually.”

— Eloy Yndigoyen, CFO, Spread the Love

2. Visibility: Single Source of Truth

Discrepancies between your inventory system, your balance sheet, and statement of cash flow are a classic symptom of disconnected software. An ARP creates inherent data integrity, because every transaction is recorded in one place to establish a single, verifiable source of truth that you can trust. You can drill down from a line on your P&L directly to the source PO or sales order, all within the same platform.

This not only makes month-end closing and audits less painful, but it also provides operational context for financial decision making around profit/loss (P&L) and margin optimization.

3. Experience: Stronger Partner Relationships

When your systems work together seamlessly, so do your relationships with vendors and customers. Faster payment and order processing improves satisfaction, trust, and retention.

Interlinking payables to procurement and receiving makes it easier to pay vendors accurately and on time. This strengthens your position as a preferred partner to secure better terms.

On the customer side, connecting sales and fulfillment data directly to your invoicing process eliminates costly errors and delays. Timely, accurate billing is as important to customer satisfaction as fast, accurate order processing. Automate it all and watch your cash flow grow.

The Smart Integration Strategy: A Phased Approach

If you’re ready to move to DOSS ARP, you’ll likely fall into one of two camps. Newer companies often prioritize operational improvements, integrating DOSS with their existing AP/AR systems rather than a full general ledger (GL) overhaul. Later stage businesses may be migrating from a full-stack ERP, ready to integrate all operations and finance into DOSS for initial deployment. For the former scenario, we typically recommend a phased integration approach.\

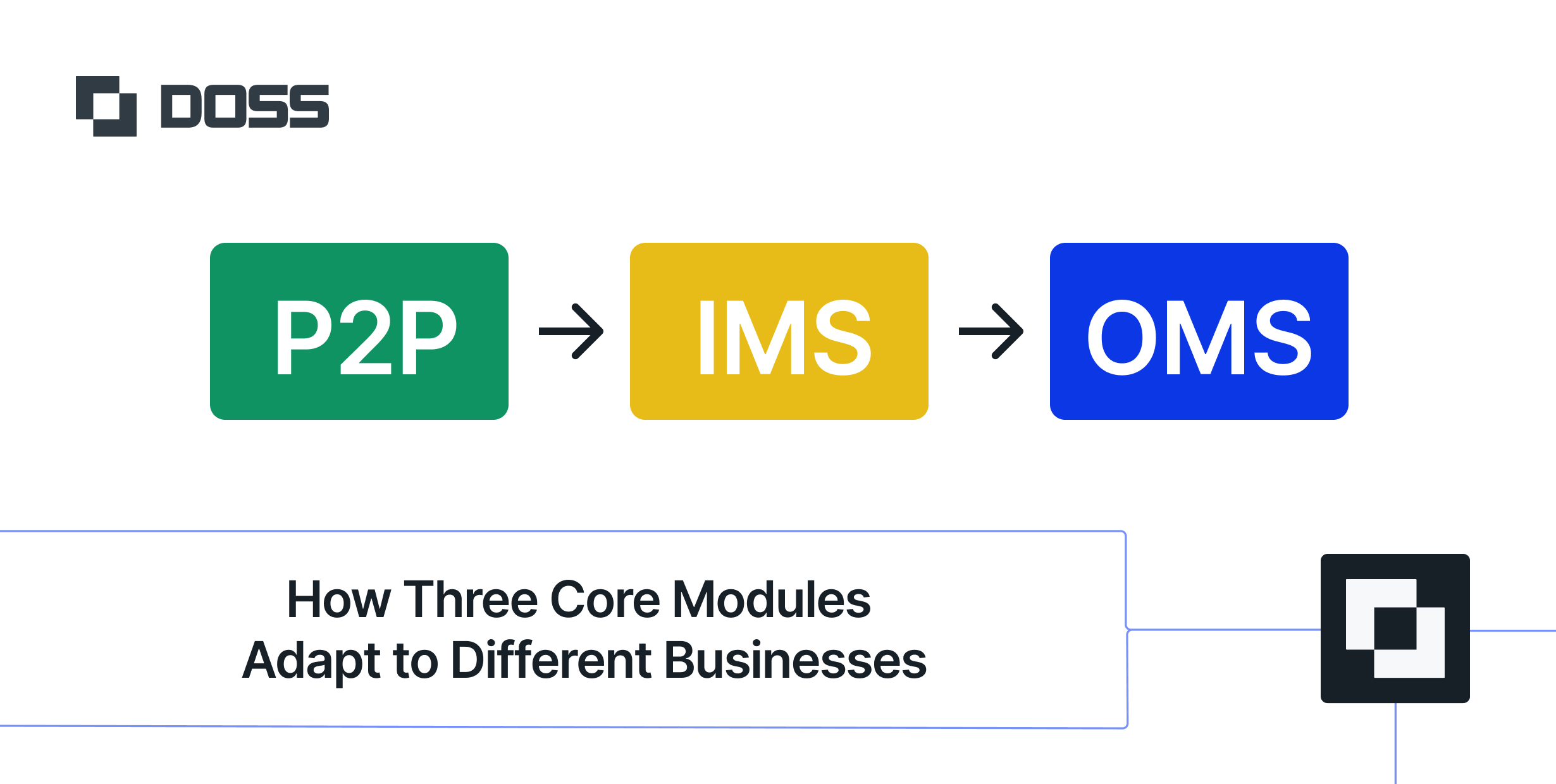

Phase 1: Stabilize Operations, Keep Your GL

For most scaling businesses, the most acute pains aren’t in the GL; they’re in procurement (P2P) , inventory management (IMS) , and order fulfillment (OMS) . The logical first step is to implement an operational core that solves these immediate challenges.

During this phase, you can continue integrating your existing accounting software as the GL, while building integrations that improve accuracy without disrupting daily operations.

Phase 2: Integrate GL When It Hurts Most

It’s time to move your accounting functions fully into the ERP when specific triggers appear:

- Manual reconciliation becomes a major time sink. The effort required to reconcile data between your ops and finance platforms starts to outweigh the convenience.

- Your financial reporting lags reality. If finance can’t close the books and deliver accurate reports until weeks after the period ends, you’re dealing with stale data.

- Scaling bottlenecks trigger the need for automation. You need to understand profitability by SKU, channel, or customer, and patching it together feels impossible.

When these bottlenecks appear, the path forward is clear. Integrating finance isn’t a complex migration; it’s simply the next step to get your operations un-stuck.

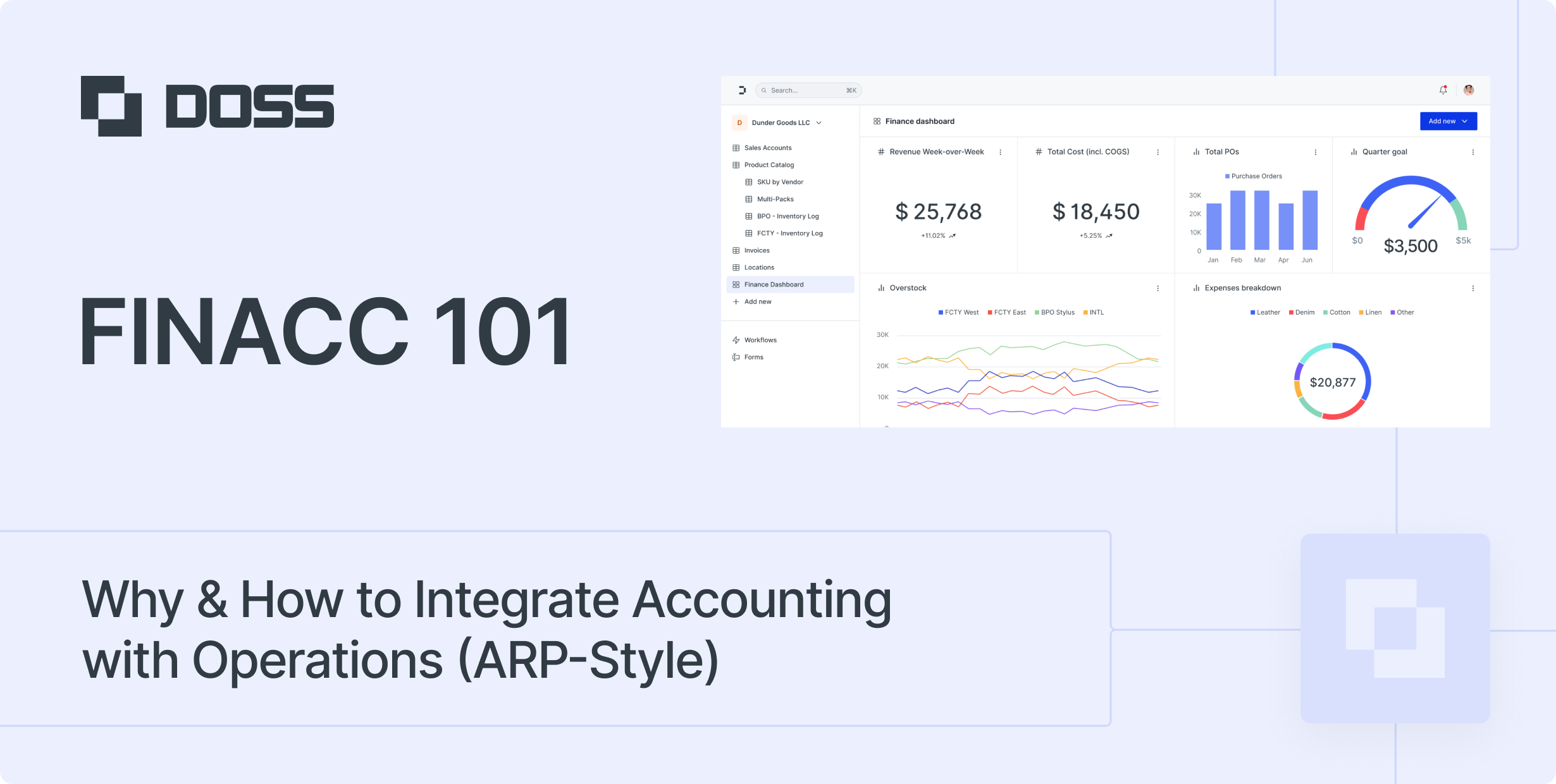

DOSS FINACC: Accounting Built for Modern Operations

Our Finance & Accounting (FINACC) module was designed as the logical financial engine for a modern operational core. It isn’t a standalone accounting tool bolted on; it’s purpose-built to leverage the rich transactional data already flowing through DOSS via AP, AR, and a full GL.

1. AP: Comprehensive Accounts Payable Management

Move your AP function from a cost center to a strategic hub for managing cash flow. FINACC automates invoice capture, three-way matching, and approval workflows. It gives you a clear view of liabilities and enables you to manage vendor payments and relationships with precision.

- Smart invoice capture with OCR and email integration

- Automated three-way matching against purchase orders and receipts

- Configurable approval workflows based on amounts and authorization matrices

- Multiple payment methods including ACH, wire transfers, and check printing

- Vendor portal integration for self-service and better relationships

2. AR: Robust Accounts Receivable Functionality

Accelerate your order-to-cash cycle. Invoices are generated automatically from shipment data, and our system provides tools for intelligent collections, credit management, and streamlined cash application, ensuring your cash flow is as healthy as your sales figures.

- Automated invoicing from sales orders and shipments

- Intelligent collections management with aging analysis and automated follow-up

- Flexible payment terms supporting complex B2B arrangements

- Cash application automation that handles partial payments and discounts

- Customer credit management with real-time exposure monitoring

3. GL: Integrated General Ledger Excellence

The GL in DOSS is the ultimate source of truth, updated in real-time by every operational transaction. Journal entries are created automatically from procurement, sales, and inventory movements, giving you an always-on, audit-ready view of your company’s financial standing.

- Automatic journal entries from operational transactions

- Real-time financial reporting with customizable dashboards

- Multi-entity support for companies with multiple divisions

- Automated reconciliation between subsidiary ledgers and GL

- Comprehensive audit trails connecting every entry to source documents

Ready to Transform Your Financial Operations?

Think of it this way: if accounting software is like having a great calculator, ARP is like having a complete financial control center that automatically updates as your business operates.

The goal isn’t just to replicate what your old accounting software did. It’s to build a resilient financial foundation that allows your business to scale without being crushed by complexity. When your operations and financials speak the same language, you unlock a new level of efficiency and strategic insight.

Ready to map out your transition from standalone accounting to a fully integrated operational core? Let's have a conversation.