The beauty industry thrives on variety. From foundations in 40-50 shades to seasonal collections and limited-edition collaborations, cosmetics brands face unprecedented SKU (Stock Keeping Unit) complexity. While product diversity drives customer satisfaction and market share, it also creates significant operational challenges that can impact profitability, inventory management, and supply chain efficiency.

The global cosmetics market, valued at $450 billion in 2024 , continues to grow despite increasing complexity. As brands expand their portfolios to meet diverse consumer needs, effectively managing this SKU proliferation has become a critical competitive advantage. The good news? With the right strategies and systems in place, brands can maintain product variety while controlling operational costs.

The SKU Proliferation Challenge in Cosmetics

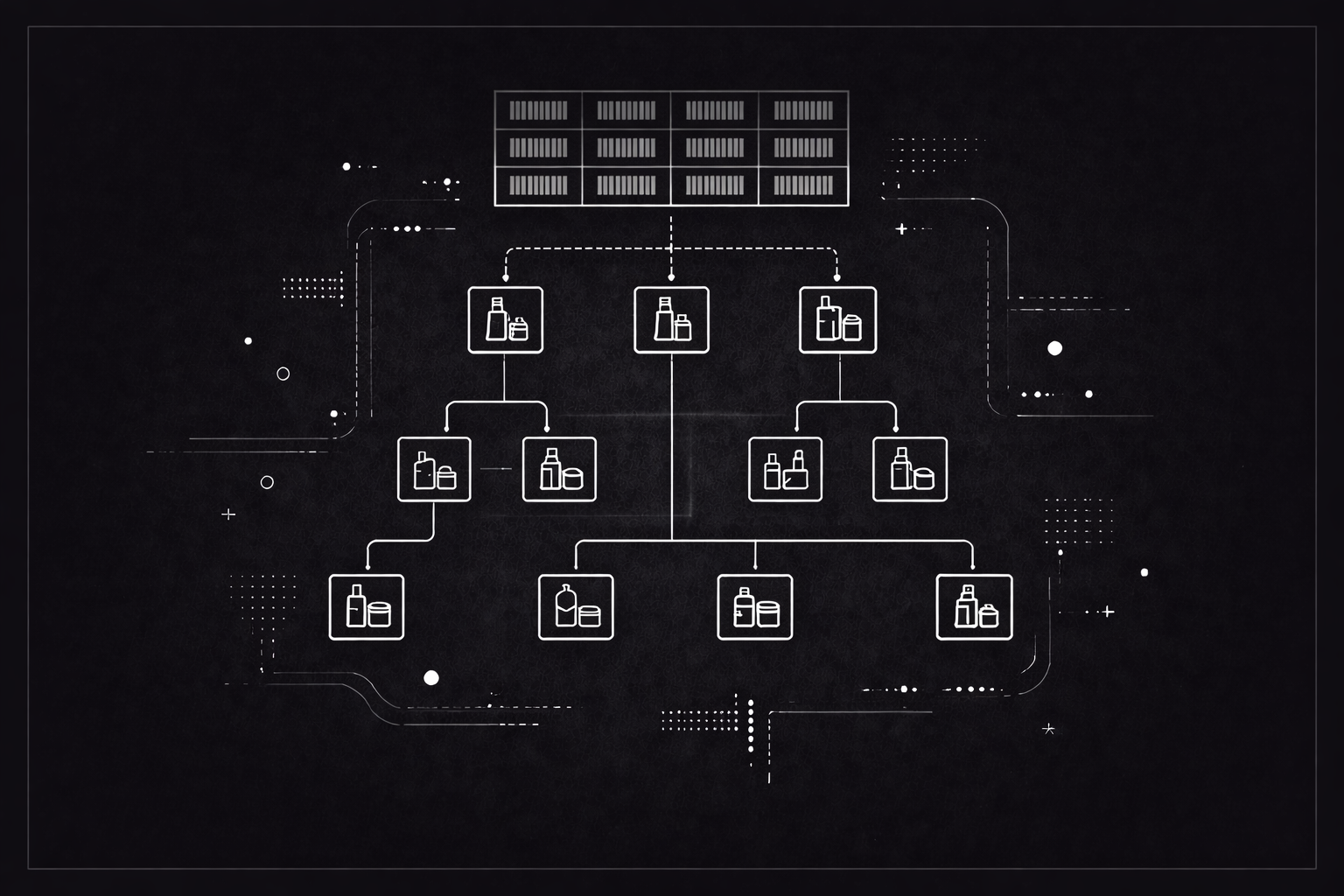

Modern cosmetics brands manage hundreds or even thousands of SKUs across multiple product categories. A single foundation line might generate 40-50+ SKUs when accounting for different shades—brands like Fenty Beauty and Lancôme now offer 50-55 foundation shades to meet inclusive beauty standards. When you factor in different sizes, formulations, and packaging options, the numbers multiply rapidly. According to industry research, variants in shades, formulas, sizes, and bundles multiply SKUs exponentially , complicating warehouse management and inventory forecasting.

Consider a typical product launch: a new lipstick line with 30 shades, available in both standard and mini sizes, creates 60 SKUs immediately. Add a limited-edition holiday packaging variant, and you're at 90 SKUs for a single product concept. Multiply this across multiple product categories—foundation, concealer, powder, blush, eyeshadow, lipstick, lip gloss—and a mid-sized brand can easily manage 500-1,000 active SKUs. Larger brands often juggle several thousand.

This complexity stems from several industry-specific factors. Consumer demand for inclusive shade ranges has rightfully pushed brands to expand their color offerings. Fenty Beauty pioneered this movement in 2017, launching with 40 foundation shades and expanding to 50 , setting a new industry standard that competitors have rushed to match. Seasonal trends and limited-edition releases keep brands relevant and drive repeat purchases. Multi-channel retail strategies require different packaging and sizing for various distribution channels. Regional preferences and regulatory requirements create additional SKU variations for international markets.

The pressure to innovate constantly also drives SKU expansion. Beauty consumers expect newness—new formulations, new shades, new finishes. Brands that fail to innovate risk losing market share to more agile competitors. Yet each new product introduction adds layers of operational complexity that must be carefully managed.

Operational Impacts of SKU Complexity

Understanding the full impact of SKU complexity is the first step toward addressing it. The consequences of poor SKU management extend throughout the entire value chain, but recognizing these patterns can help you identify opportunities for improvement.

Inventory challenges emerge as brands struggle to forecast demand across hundreds of variations, leading to overstocking of slow-moving shades while bestsellers face stockouts. A case study from L'Oréal, which manages over 36,000 products across 500+ brands , demonstrates the scale of this challenge. Working capital becomes tied up in excessive inventory, impacting cash flow and profitability.

Manufacturing operations become increasingly complex as production runs shrink and changeover times increase. This reduces manufacturing efficiency and drives up per-unit costs. Procurement teams face difficulties maintaining relationships and negotiating favorable terms when ordering smaller quantities of specialized ingredients and packaging components.

Warehouse operations suffer as storage requirements expand and picking accuracy becomes more challenging with similar-looking products. Distribution networks experience higher fulfillment costs and increased error rates. The retail environment becomes cluttered, making it harder for customers to navigate options and for sales staff to maintain product knowledge.

The key is recognizing these pain points early and implementing targeted solutions before they significantly impact your bottom line.

Strategic Approaches to SKU Rationalization

Successful cosmetics brands take a data-driven approach to managing their product portfolios. Here's how you can start optimizing yours:

Begin with comprehensive SKU analysis examining sales velocity, profitability margins, inventory turnover rates, and cannibalization effects between similar products. Advanced analytics can reveal which SKUs truly drive value versus those that simply add complexity without contributing to your bottom line. Look at performance across multiple dimensions—not just total revenue, but profit margin, inventory turns, and customer acquisition potential.

Product lifecycle management becomes essential in this context. Establish clear criteria for introducing new SKUs, including minimum projected sales volumes, margin requirements, and strategic fit. Regular portfolio reviews—ideally quarterly—should identify underperforming products for discontinuation or consolidation. Consider strategic formulation and packaging choices to reduce complexity, such as creating base formulas that work across multiple shade families or standardizing packaging components across product lines.

One practical approach: Start by analyzing your bottom 20% of SKUs by revenue. Calculate their true cost including storage, handling, and opportunity cost. You may find that eliminating or consolidating these products frees up resources for your top performers without impacting overall revenue. Many brands discover that discontinuing their bottom 10-15% of SKUs reduces revenue by only 2-3% while dramatically simplifying operations.

Another effective strategy is shade rationalization within existing lines. If you have a 50-shade foundation range, analyze which shades rarely sell. You might find that certain mid-tone shades with similar undertones cannibalize each other's sales. Consolidating these into fewer, more distinct options can simplify your operations without reducing your ability to serve diverse customers. The key is using data to make these decisions rather than gut instinct.

Technology Solutions for SKU Management

Technology is your greatest ally in managing SKU complexity at scale. Modern inventory management systems provide real-time visibility across the supply chain, enabling more accurate demand forecasting and automated reordering for fast-moving SKUs. These systems can alert you to potential stockouts before they happen and identify slow-moving inventory before it becomes a problem.

Product information management (PIM) platforms centralize data about ingredients, regulatory compliance, marketing content, and technical specifications for each SKU, ensuring consistency across channels. This becomes invaluable when managing hundreds of products across multiple markets with different regulatory requirements. A robust PIM system ensures that when you update a product formulation or need to respond to a regulatory change, you can update information across all channels simultaneously rather than manually updating each platform.

Advanced forecasting tools leverage machine learning to predict demand patterns across SKU portfolios, accounting for seasonality, trends, and promotional activities. These tools can identify patterns that human analysts might miss, such as which shade ranges tend to sell together or how weather patterns affect product demand. For example, they might detect that sales of certain foundation shades spike in specific geographic regions during particular months, allowing you to optimize inventory placement accordingly.

Supply chain visibility platforms track raw materials and finished goods across global networks, helping you identify bottlenecks and optimize fulfillment strategies. The investment in these technologies typically pays for itself through reduced carrying costs and improved inventory turnover. These platforms become especially valuable when managing complex, multi-tier supply chains with components sourced from different regions and products manufactured in various facilities.

Integration between these systems is critical. When your PIM, inventory management, and forecasting tools share data seamlessly, you gain a comprehensive view of your operations that enables better decision-making at every level.

Operational Best Practices

Leading cosmetics brands implement several operational strategies to manage complexity effectively, and you can too:

Standardize where possible. Use base formulations and packaging components wherever feasible to achieve economies of scale while maintaining apparent variety. This doesn't mean sacrificing creativity—it means being strategic about where complexity adds value.

Optimize manufacturing schedules. Group similar products using campaign planning to minimize changeover times. Even small reductions in setup time can significantly impact your cost per unit when multiplied across hundreds of production runs.

Consolidate vendors strategically. Reduce supplier management overhead while improving negotiating leverage. Strategic partnerships with key ingredient and packaging suppliers enable better collaboration and innovation. Consider establishing long-term agreements with fewer suppliers rather than constantly shopping for the lowest price.

Implement tiered service levels. Maintain higher inventory levels for core SKUs while using make-to-order or quick-replenishment strategies for specialty items. This approach lets you serve niche markets without tying up capital in slow-moving inventory.

Remember: the goal isn't to eliminate all complexity, but to ensure that every SKU you carry earns its place in your portfolio.

The Financial Equation of SKU Management

Understanding the true cost of each SKU is crucial for making informed decisions. Every SKU carries hidden costs beyond the obvious manufacturing and inventory expenses. These include the complexity costs of procurement, quality control, regulatory compliance, warehouse space, supply chain coordination, and marketing support.

To get a clear picture, calculate the true profit contribution of each SKU by accounting for all these factors, not just gross margin. Create a simple framework that includes:

- Direct costs (manufacturing, materials, packaging)

- Indirect costs (warehouse space, handling, quality control, regulatory compliance)

- Opportunity costs (working capital tied up, shelf space that could go to better performers)

- Marketing and promotional expenses (dedicated campaigns, sampling programs, retailer support)

- Complexity costs (additional supplier management, production changeovers, forecasting difficulty)

When you account for all these factors, you often discover surprising insights. A product with a 60% gross margin might actually generate negative returns when you factor in the warehouse space it occupies for months, the complexity it adds to your supply chain, and the marketing investment required to move it. Conversely, a product with a 45% gross margin that turns inventory quickly and requires minimal handling might be far more profitable in practice.

Analysis often reveals that a small percentage of SKUs generate the majority of profits, while many products actually destroy value when all costs are considered. The Pareto Principle, or 80/20 rule, typically applies to cosmetics inventory : approximately 20% of SKUs generate 80% of revenue.

The results can be eye-opening. When L'Oréal partnered with ToolsGroup to optimize its inventory , they reduced inventory levels by 15%, increased service levels by 5%, reduced stockouts by 50%, and saved over $10 million annually in inventory costs. This insight enables better decision-making about portfolio optimization and resource allocation.

Don't let attachment to products cloud financial judgment. Just because a shade was popular three years ago or a product extension seemed like a good idea at launch doesn't mean it deserves continued investment. Let the data guide your decisions, and be willing to make tough calls about discontinuation when the numbers justify it.

Future Trends in SKU Management

The cosmetics industry continues to evolve, and staying ahead of these trends will be essential for maintaining competitive advantage. Personalization and customization are creating new challenges as brands offer made-to-order products, custom shade matching, and personalized formulations. This potentially transforms thousands of SKUs into millions of unique variations. As the industry grows, online channels are expected to account for nearly one-third of global beauty sales by 2030 , up from 26% in 2024.

Sustainability pressures are driving demand for refillable packaging and reduced waste, requiring new operational models. Direct-to-consumer channels are shifting inventory dynamics and creating opportunities for more agile, responsive SKU strategies. Over 40% of beauty businesses are now utilizing artificial intelligence to analyze sales trends and manage inventory, enhancing forecasting accuracy and operational efficiency.

Successful brands are investing in flexible manufacturing capabilities, digital supply chain twins for scenario planning, and AI-powered demand sensing to stay ahead of these trends. The brands that thrive will be those that can balance innovation and variety with operational efficiency.

Partnering for Success

Managing SKU complexity at scale requires sophisticated operational expertise and technology infrastructure that many brands struggle to build internally. Even with the best strategies in place, executing them consistently while maintaining focus on your core business—creating great products and building your brand—can be challenging. This is where specialized partners become invaluable.

DOSS provides cosmetics brands with comprehensive solutions to simplify SKU management across the entire value chain. From intelligent inventory optimization and demand forecasting to fulfillment operations and supply chain visibility, DOSS helps beauty brands reduce complexity costs while maintaining the product variety that drives customer satisfaction. By partnering with DOSS, cosmetics companies can focus on innovation and brand building while leaving the operational complexity to experts who understand the unique challenges of beauty industry logistics.

The right partner doesn't just solve today's problems—they help you build the foundation for sustainable growth as your brand scales.